21+ Crummey Trust Letter Sample

To be eligible for the annual gift tax exclusion currently thirteen. Establishing a trust may be on your estate planning to-do list if you want to preserve your wealth for future generations while potentially enjoying.

Template Net

Web Result Parents may prefer a Crummey trust over a Sec.

. 2503c trust to gain more certainty over the termination of the trust. Web Result Under the trust instrument you are given the right to withdraw any transfers made to the trust within thirty 30 days after each contribution. Web Result August 11 2020.

Money Back Guarantee30 Day Free TrialEdit On Any Device. Web Result Sample Crummey Notice. Web Result If you have a trust or trusts with Crummey powers and you have made contributions to or on behalf of your trust during 2008 and not already done.

It has three main players. Notice of right to withdraw funds. Web Result A Crummey trust takes its name from a famous tax case involving Reverend Crummey who was probably teased mercilessly growing up.

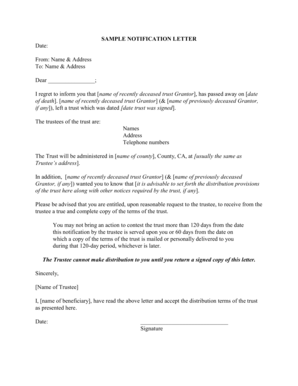

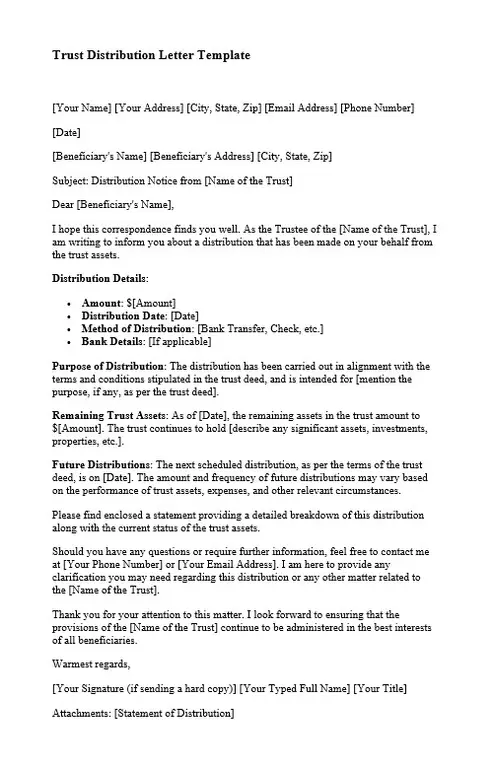

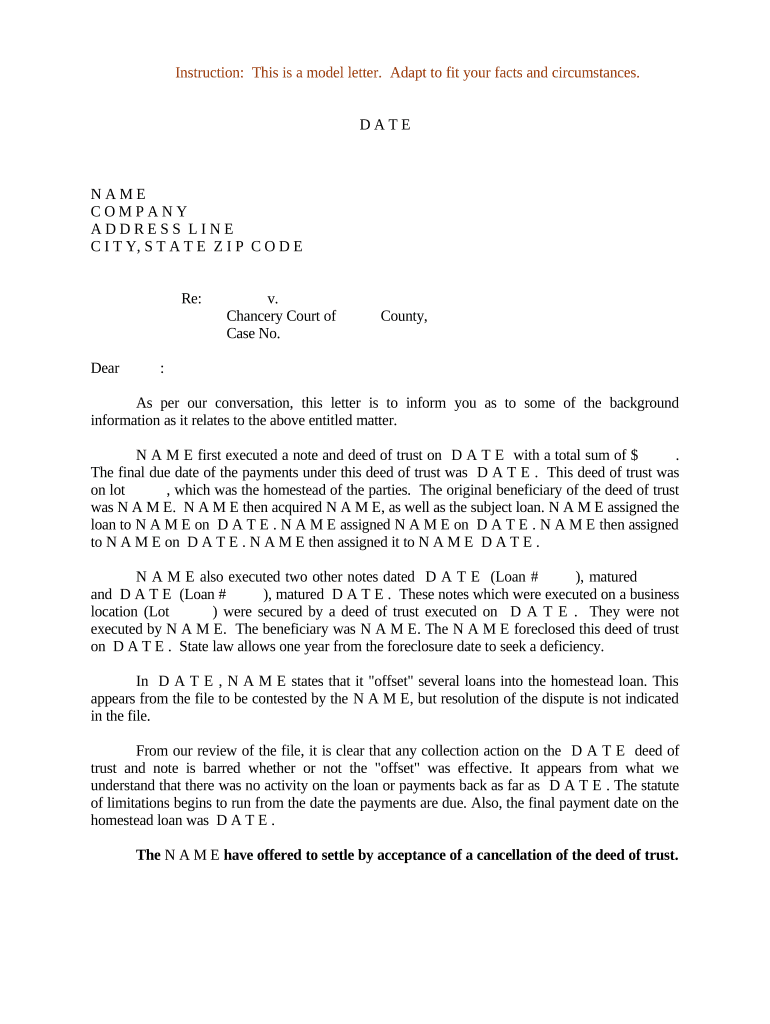

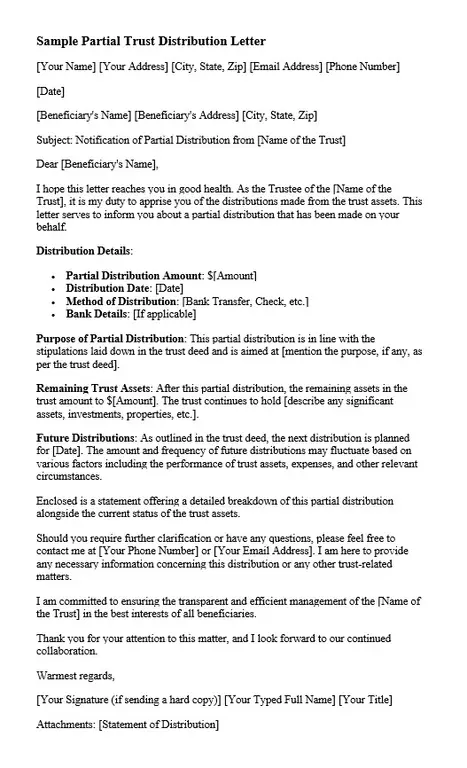

Web Result At its most basic a Crummey Notice is just a letter letting a beneficiary know that assets have been added to a trust and informing the beneficiary of hisher right to. Web Result Here is a sample of Crummey beneficiary letter. Many parents and grandparents want to pass their.

You can fill on your personal. Web Result In Crummey trusts the trustee of the trust must send letters to the trust beneficiaries and offer them the right to withdraw a certain portion of the gift for a. Assets in a Sec.

1 a grantor who creates the trust. Web Result A Crummey trust is created with the same basic ingredients as any other form of trust. If you are looking for a Crummey letter template feel free to use this on.

Web Result LEARN MORE. A Safe Way to Give Financial Gifts to Minors. Web Result With a Crummey Letter one can prove that the right to enjoy funds has been given by the trustor during every tax year.

Many estate plans call for annual gifts to heirs often through trusts. Web Result A Crummey Trust is an irrevocable trust that permits the gifting of assets to beneficiaries without utilizing the lifetime gift tax exemption by granting. Web Result Dear Clients Colleagues and Friends If your life insurance policy is owned by an Irrevocable Life Insurance Trust ILIT you know what a pain it is to.

Trust Name Trust Date. Web Result The Basic Crummey Approach. Web Result For those who have utilized Irrevocable Gifting Trusts or Irrevocable Life Insurance Trusts a Crummey Letter is required each year for purposes of gifting.

Beneficiarys Full Name and Address.

1

Us Legal Forms

Signnow

Signnow

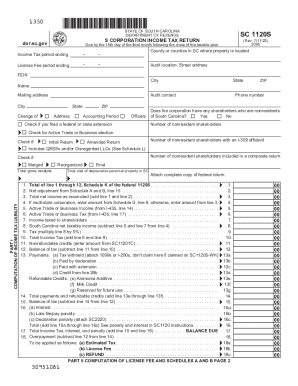

Pdffiller

Facebook

Calypso Tree

Signnow

Pdffiller

Dochub

Dochub

Signnow

Www 21stcenturytrust Org

Dochub

Dochub

Calypso Tree

Signnow